gusto colorado paycheck calculator

Automatic deductions and filings direct deposits W-2s and 1099s. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

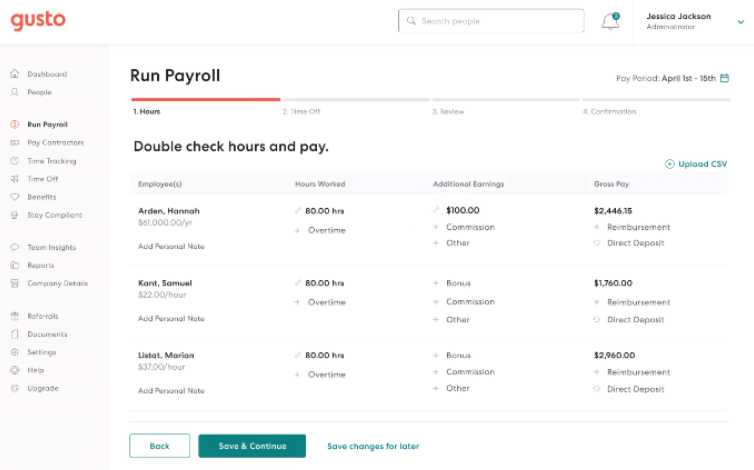

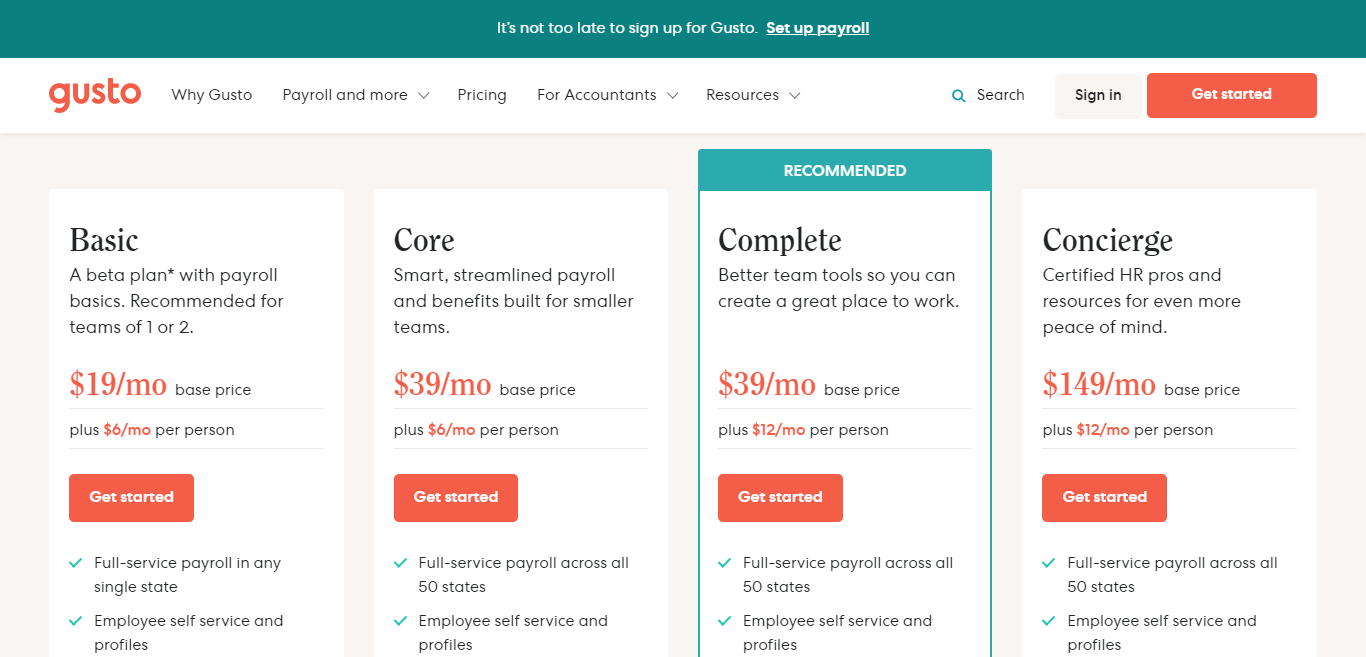

Top 3 Payroll Software Comparison Of Gusto Sage 50cloud Payroll And Onpay Financesonline Com

Change state Check Date General Gross Pay Gross Pay Method.

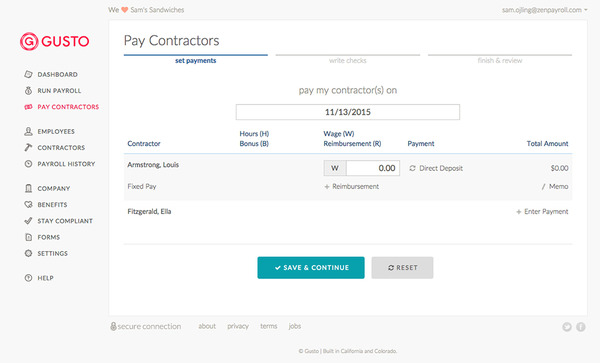

. The average Gusto hourly pay ranges from approximately 20 per hour for a Customer Service Representative to 21 per hour for a Member Operations. Register a company with state and local agencies on your own. Forms we file in Colorado.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Let Gusto register for you.

Figure out your filing status work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in North Carolina. Legally pay departing employees.

Ad Designed for small business ezPaycheck is easy-to-use and flexible. Finding a New Payroll Solution Can be Complex But It Doesnt Have to Be. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

How to calculate annual income. We use the most recent and accurate information. Gusto Colorado Paycheck Calculator.

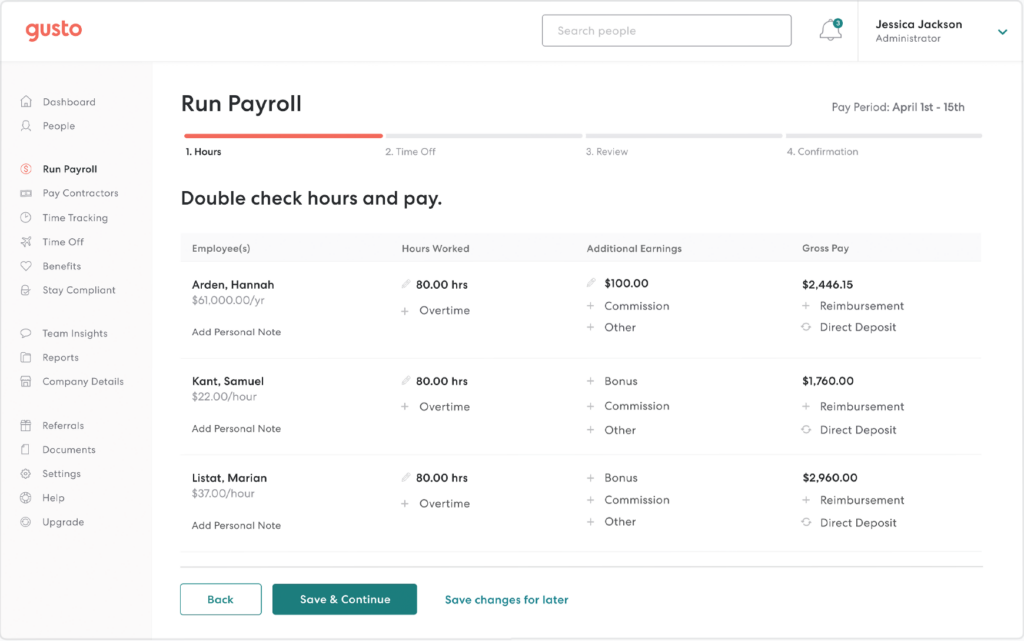

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Gusto colorado paycheck calculator. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in California.

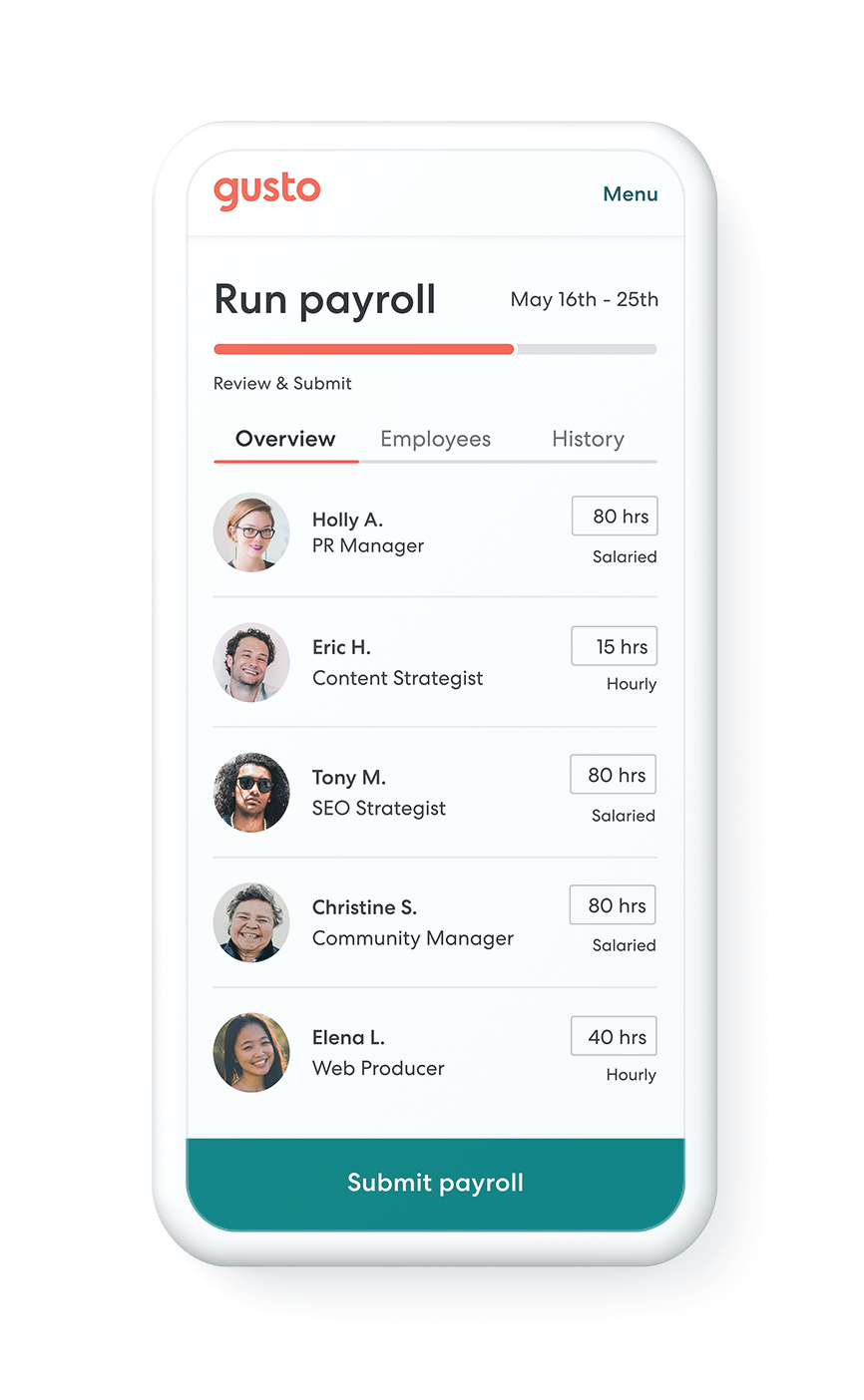

Gusto Embedded Payroll Build apps with Gusto Developer tools Get started Interactive Demo Contact Sales 800 936-0383. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Colorado.

Most states require that employers give departing employees their dismissal or final paychecks within a set period of time or even on the employees last day of work. Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator. This Colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Salary Paycheck Calculator Colorado Paycheck Calculator Use ADPs Colorado Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. All Services Backed by Tax Guarantee. Ad Best Alternatives For Managing Your Entire Business The Easiest Possible Way.

Ad Payroll So Easy You Can Set It Up Run It Yourself. 10month for up to 5 employees 100employeemonth for additional employees. In some states the time period varies depending on whether the employee quit or was firedlaid off.

Switch to Colorado hourly calculator. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Colorado salary paycheck and payroll calculator.

Switch to salary Select Your State Where does your business operate. Colorado Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. State Date State Colorado.

Switch to salary Hourly Employee. Switch to salary Hourly Employee. EzPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

Why Gusto Payroll and more Payroll. Finding your tax account number s and rates and entering them in Gusto. Use this payroll tax calculator to see how adding new employees will affect your payroll taxes.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. Ad In a few easy steps you can create your own paystubs and have them sent to your email. Update all references in word.

The aggregate method which youll use if you pay supplemental and regular wages at the same time is a little more complicated and requires you to check out the tax rates listed on irs publication 15. Dismissal paycheck requirements by state. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Note that these are marginal. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Third party authorization TPA infoTPA is required in this state. Find account numbers and rate infothe company is already registered with the state. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Overview of Colorado Taxes Colorado is home to Rocky Mountain National Park upscale ski resorts and a flat income tax rate of 45. Switch to salary Hourly Employee.

Just enter the wages tax withholdings and other information. Create professional looking paystubs. This free easy to use payroll calculator will calculate your take home pay.

Symmetry Software Joining Gusto Symmetry Software

![]()

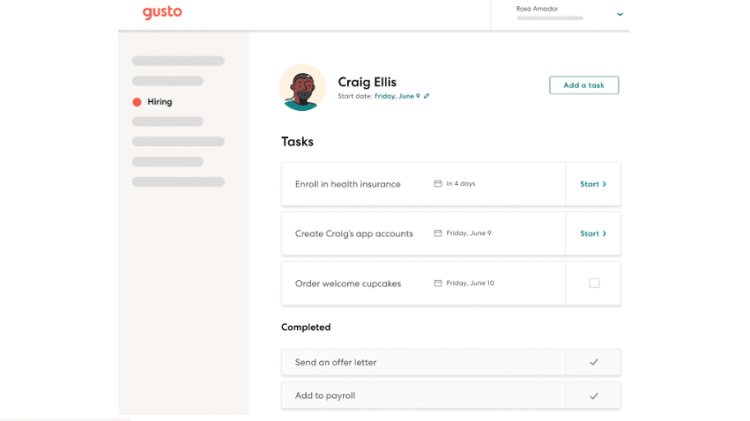

Gusto Review Solid Payroll Software Mixed With Time Management

How Do I Calculate A Tip Credit Ask Gusto

![]()

Gusto Review 2022 Pricing Features Shortcomings

Gusto Review Is This The Best Payroll Service Right Now

Gusto Review Solid Payroll Software Mixed With Time Management

Different Types Of Payroll Deductions Gusto

Gusto Review Solid Payroll Software Mixed With Time Management

Gusto Review Is This The Best Payroll Service Right Now

The Best Payroll Service For Sole Proprietors Or S Corp

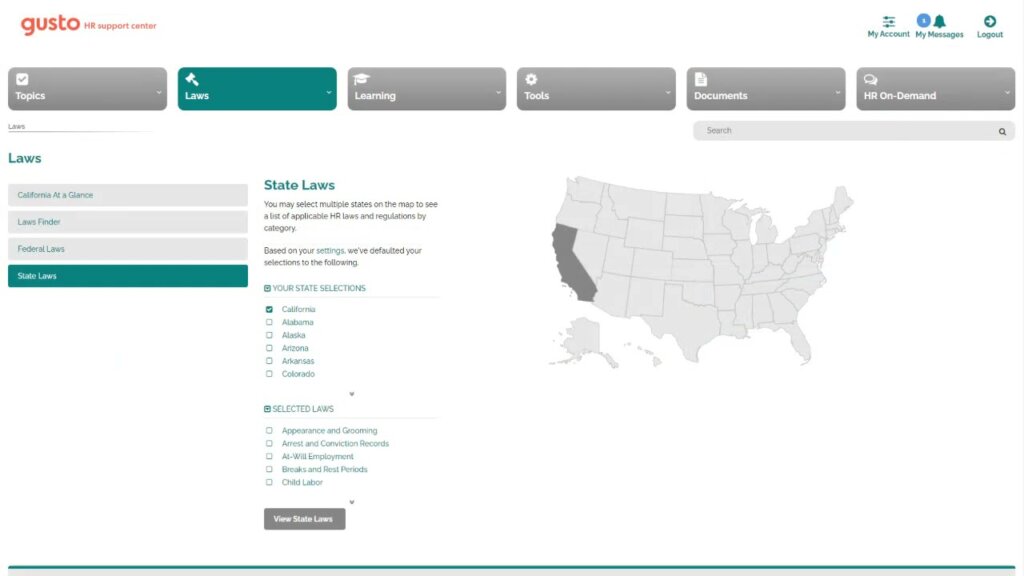

Free Payroll And Hr Resources And Tools Gusto

What Makes Gusto A Top Choice For Sole Proprietors Financesonline Com

Gusto Hr Payroll Partner Flowhub

Here S How To Read A Pay Stub With Sample Paycheck Youtube

Gusto Review Is This The Best Payroll Service Right Now

Here S How To Read A Pay Stub With Sample Paycheck Youtube